In the evolving real estate landscape of Southwest Florida—spanning Naples, Fort Myers, Estero, Bonita Springs, and Port Charlotte—understanding the latest mortgage market changes is critical for success. These updates not only affect how transactions are conducted but also influence how real estate professionals can better serve their clients in a competitive market. This comprehensive guide will walk you through key updates and strategies to help you navigate these changes effectively.

Understanding Interested Party Contributions (IPCs)

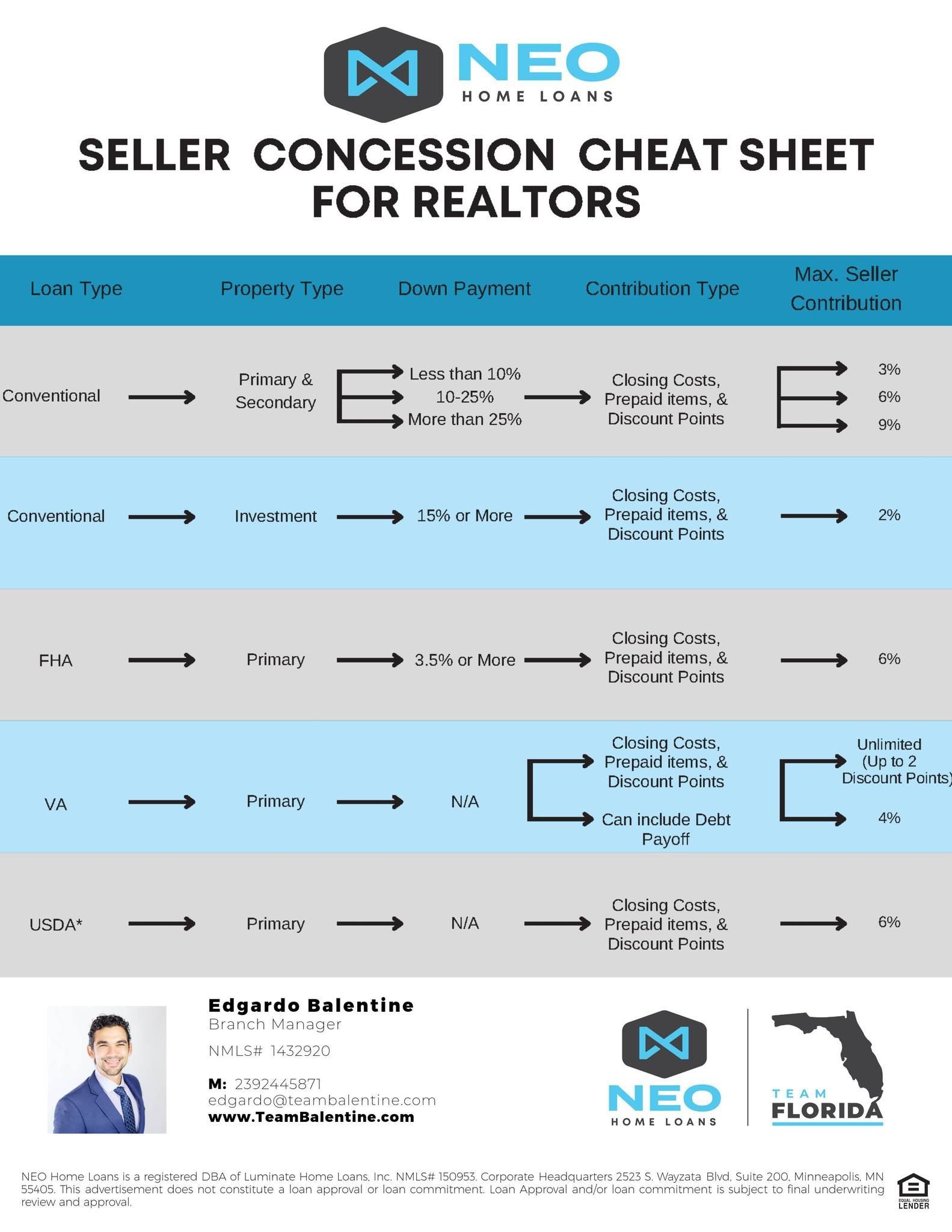

One of the most important updates in the mortgage market is the adjustment in Interested Party Contributions (IPCs). IPCs refer to the maximum amount that sellers, builders, or other interested parties can contribute towards a buyer’s closing costs, prepaid expenses, and interest rate buy-downs. These contributions are crucial in negotiations, as they directly impact the financial terms of a transaction.

For conventional loans, the maximum IPCs vary depending on the down payment and whether the property is a primary residence, vacation home, or investment property. For example, a buyer putting down the minimum down payment on a primary residence can receive up to 3% of the purchase price in seller contributions. However, this can increase to as much as 9% with a higher down payment. On the other hand, investment properties are capped at 2%.

For FHA loans, a flat 6% is allowed, while USDA loans also permit up to 6% in contributions. VA loans typically allow 4%, but in practice, they can go up to 6% depending on the circumstances. Importantly, Realtor commissions are not subject to these IPC limits, which means you can negotiate seller contributions for closing costs without affecting your commission.

Navigating Appraisal Gaps

Appraisal gaps are becoming a more frequent challenge in today’s market, particularly as home prices fluctuate. An appraisal gap occurs when the appraised value of a property comes in lower than the purchase price. This gap can create significant hurdles for both buyers and sellers, particularly when financing is involved.

To address this, it’s essential to prepare your clients for potential appraisal gaps before they arise. Discussing Plan B scenarios upfront can prevent surprises and keep transactions on track. One effective strategy is utilizing down payment assistance programs, which can help bridge the gap between the appraised value and the purchase price without requiring the buyer to come up with additional cash.

For buyers who are set on putting 20% down to avoid mortgage insurance, the appraisal gap strategy can be particularly useful. Instead of requiring the buyer to bring more money to the table, the loan amount can be adjusted slightly to cover the difference. For instance, increasing the loan amount by a few thousand dollars and applying it toward a prepaid mortgage insurance premium can maintain the original down payment and monthly payment goals, even if the appraisal comes in lower than expected.

Leveraging Alternative Financing Options

The mortgage market is not one-size-fits-all, and that’s especially true for investors and buyers in the luxury market. Understanding and offering alternative financing options can set you apart as a knowledgeable agent capable of navigating complex financial situations.

- Jumbo Loans:

Jumbo loans are a critical tool for buyers in high-end markets like Naples and Bonita Springs. These loans, which exceed the conforming loan limits set by Fannie Mae and Freddie Mac, are designed for financing luxury properties. With jumbo loans, buyers can finance homes priced up to $66 million, making them ideal for Southwest Florida’s luxury real estate market. These loans typically require a strong down payment—often 20% or more—but they offer competitive rates and terms.

- DSCR Loans:

For real estate investors, Debt Service Coverage Ratio (DSCR) loans offer a unique advantage. These loans are based on the cash flow generated by the property rather than the borrower’s personal income. This makes them ideal for investors looking to finance multiple properties or those who may not have a traditional income structure. DSCR loans allow investors to close in the name of an LLC and often come with more flexible underwriting criteria.

- Foreign National Loans:

Southwest Florida’s real estate market is attractive to international buyers, and foreign national loans cater to this demographic. These loans allow non-U.S. citizens to finance properties in the United States, often with flexible requirements that take into account the unique financial circumstances of foreign buyers. With down payments starting at 25%, these loans are a valuable tool for tapping into the international market.

Preparing for Market Fluctuations

As the real estate market in Southwest Florida continues to evolve, particularly with the expected changes in interest rates, it’s crucial to be prepared for fluctuations. Interest rates have a significant impact on buying power and market activity, and understanding how to navigate these changes is key to advising your clients effectively.

- Interest Rate Buy-Downs:

One strategy to consider is the use of interest rate buy-downs. This involves negotiating with the seller to cover the cost of buying down the buyer’s interest rate, effectively lowering their monthly mortgage payment. This strategy can be particularly useful in a rising rate environment, where buyers may be hesitant to move forward due to higher costs.

- Down Payment Assistance Programs:

Down payment assistance programs are another critical tool, especially for first-time homebuyers who may be struggling to save for a down payment. These programs can bridge the gap between what a buyer can afford and what is required, making homeownership more accessible even in a fluctuating market.

Enhancing Client Communication and Conversion

In today’s competitive market, communication and transparency with clients are more important than ever. By integrating financial knowledge into your client interactions, you can provide a more comprehensive service and build trust with your clients.

Pre-Purchase Consultations:

Offering pre-purchase consultations is an excellent way to set the stage for a successful transaction. During these consultations, you can walk clients through various financing options, discuss potential challenges such as appraisal gaps, and outline the steps they need to take to secure their dream home. This proactive approach not only builds confidence but also positions you as a trusted advisor.

Adopting Clients for Future Transactions:

Even if a client decides to go with another agent or lender, it’s important not to close the door on future opportunities. By offering value-added services, such as providing market updates or home valuation reports, you can stay top-of-mind for future transactions. This approach ensures that when clients are ready to buy or sell again, they think of you first.

Conclusion:

Adapting to Thrive in a Changing Market

The real estate market in Southwest Florida is dynamic and ever-changing. By staying informed about mortgage updates and leveraging alternative financing options, you can better serve your clients and close more deals. Whether it’s navigating appraisal gaps, offering jumbo loans, or utilizing down payment assistance programs, the key is to be proactive and knowledgeable.

As you continue to guide clients through the buying and selling process, remember that your expertise in financing can be a significant differentiator. By integrating these strategies into your practice, you’ll be well-positioned to thrive in any market conditions.